Procure-to-pay is complicated by siloed, dispersed procurement software. Costly, rigid, and ineffective are procurement solutions that are out of date. Still, most businesses “make do” with their antiquated purchase management software.

Eighty percent of companies still handle their P2P cycle with manual or semi-digital methods, according to a Paystream 2023 Procurement Insights research. The procurement module is used by the majority of companies together with their accounting or ERP software. Like trying to shatter a nut with a flashlight. It is still the wrong tool even though it completes the task.

There will be problems with this misapplication before long. The bottom line of a firm will eventually suffer from the use of outdated procure-to-pay software, or worse, no solution at all. Companies must adopt digital instead of their conventional strategy if they want to survive the competition.

Here is all the information you need to select the best procure-to-pay software to ensure that your process is really efficient.

How does one go about procuring to pay?

Known by other names including purchase-to-pay and P2P, the procure-to-pay process is a sequence of procedures that businesses use to control the purchasing of products and services from outside vendors. Finding a need for products or services and ending with payment to the vendors are the several phases of the P2P process. This crucial corporate procedure guarantees effective supplier management, reduces expenses, and simplifies procurement operations.

Procurement leaders decide which phases of a procure-to-pay process are most important based on corporate practice and the requirement in issue. Here is where a tool such as Procurement Cloud is useful. Your business demands will determine how you configure your flow.

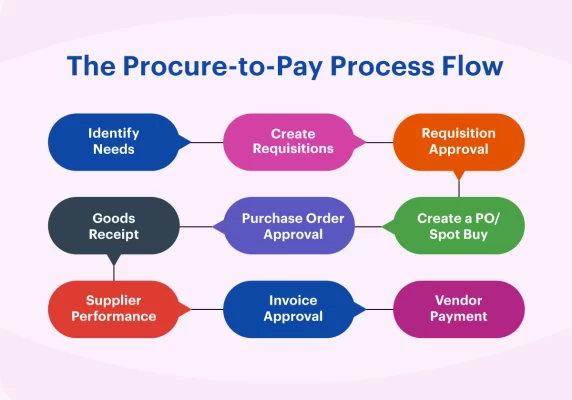

Process of procure to pay:

Determine Needs

A procure-to-pay process begins with cross-functional stakeholders helping to identify and define the business requirements. Procurement teams draft statements of work (SOW), terms of reference (TOR) for services, and high-level specifications for goods and products after a legitimate requirement is determined.

Draft Requisitions

The specifications/TOR/SOW are finalized, and then a formal purchase order is written. A requester, having made sure all administrative criteria are satisfied, submits the completed purchase requisition form. Any kind of procurement, including subcontracts and consignments as well as ordinary purchases, can have a requisition generated.

Approval of the Purchase Requisition

Department heads or procurement officials next examine submitted purchase orders. Once a purchase request has been assessed for need, the available budget has been confirmed, and the buy request form has been validated, approvers can either approve or reject it. Rejected and returned to the initiator for modification and resubmission are incomplete purchase orders.

Establish a Purchase Order or Spot Purchase

One-time unique purchases, low-value commodities, or unmanaged category buys are examples of qualities that make a spot buy possible. Purchase orders are generated, otherwise, from authorized purchase requisitions.

Approval of the Purchase Order

These days, purchase orders are routed via an approval process to guarantee the veracity and correctness of specifications. Subsequently, merchants receive approved purchase orders. Vendors can initiate a negotiation, reject, or approve the purchase order after examining it. A purchase order becomes enforceable as soon as an officer gives his or her approval.

Reception of Goods

The purchaser verifies that the provided goods or services meet the conditions of the contract whenever the promised goods or services the provider delivers. Following approval or rejection of the items receipt is determined by the criteria outlined in the purchase order or contract.

Performance of Suppliers

The performance of the suppliers is assessed using the information from the step before. Several aspects including Total Cost of Ownership (TCO), contract compliance, service, quality, and on-time delivery. Not performing is noted for future reference in current rosters and information systems.

Approval of Invoices

Following approval of a goods receipt, the purchase order, vendor invoice, and goods receipt are three-way matched. Should no errors be discovered, the invoice is accepted and sent to the finance department for payment distribution. Should an invoice contain errors, it is returned to the seller along with an explanation.

Vendor Payment

The finance staff will handle payments as per the terms of the contract once they get an approved invoice. Every modification to a contract or evaluation of liquidated financial security will be considered. A payment to a supplier might be of one of five kinds: advance, partial, progress or installment, final, and holdback/retention.

Principles of procurement to payment

The procure-to-pay process of enterprises can be made more successful and efficient by the following five P2P best practices:

- Put procure-to-pay software into use

- Maintain openness of the process

- Increase supplier involvement

- Optimise stock

- Management of contracts simplified

How may purchasing be made more efficient with procure-to-pay software?

According to a new Gartner research, over half of all companies worldwide will have a cloud-based procure-to-pay solution by 2025. Procurement software is becoming more and more popular as businesses become aware of its advantages and potential for cost savings. Examples of such applications are Procurement Cloud.

Methods to improve purchase efficiency:

1. Purchase Orders and Authorizations

Email threads are eliminated when digital procure-to-pay software routes the purchase request to all stakeholders and approvers in the proper sequence.

2. Management of Purchase Orders

From authorized purchase requisitions, most procure-to-pay systems automatically generate purchase orders and start the PO dispatch procedure. One can do anything from generate several POs from a single PR to send several batch orders to a single vendor.

3. Digital Vendor Management

Vendor management gone digital alters how your procurement staff evaluates and evaluates vendor performance. Selecting the best vendor based on performance, pricing, discounts, delivery schedule adherence, and policy compliance is made very simple with a good procure-to-pay application!

4. Matching of Invoices

Software for procuring to pay can approve invoices, handle exceptions, do three-way matching with Procurement Cloud to guarantee a foolproof purchase, and interface with electronic payments or account payable systems.

5. Five Purchase-Related Insights

The ability of reports and analysis to help you determine what is and is not working is one of the greatest aspects of automation. It provides whole transparency of the procedure. Through bespoke reports and analytics, you can so quickly check the status of every task, examine vendor performance indicators, and much more.