Effective Services for Banking Industry Clients in the Digital Age

Giving banking industry clients effective services in the continually changing digital environment nowadays primarily depends on technology.

If banks want to remain competitive, they must apply creative technologies to enhance client experiences, simplify procedures, and drive development.

Industry projections indicate that by 2025, global banking IT expenditure is likely to exceed $761 billion [1], underscoring the relevance of technology investments in the banking sector.

Technology shapes banking; hence, managers, VPs, CIOs, and IT analysts face particular challenges selecting suitable solutions to use. Obstacles include the complexity of the technological terrain, the need to balance cost and efficiency, integration difficulties, and the tremendous demand for security and regulatory compliance.

Including new technologies into present systems is one of the primary challenges in accomplishing projects related to digital transformation. Moreover, the banking industry handles particular technological problems of its own. Examples include legacy systems, data management and analytics complexity, security limitations, compliance and regulatory concerns, and integration issues. These issues demand original solutions especially suited for the sector’s demands.

This blog aims to evaluate the most recent financial technology, clarify the industry’s challenges, and demonstrate how recently developed solutions could manage these issues. By exploring the possibilities of creative ideas, we provide incisive analysis and thought leader viewpoints to assist banking sector leaders in negotiating the difficult terrain of banking technology and rendering decisions.

Technical Question: Selecting Suitable Financial Technology

Special technical problems influencing the dynamics of the banking sector affect its operations. Negotiating the various technical options might be challenging. Management, CIOs, and IT consultants have to manage problems including:

- The continually shifting landscape of banking technology, making it difficult to identify suitable solutions supporting corporate aims.

- The need to balance cost and efficiency, considering maintenance and installation costs.

- The challenge of integrating modern technologies with existing systems to avoid disturbances and ensure seamless operations.

Actually, 63% of the top 100 banks Accenture polled have already moved or are ready to move their core banking system to the cloud. Data security and privacy are stressed, making technology solutions challenging to apply. For the banking industry, cybersecurity issues create significant risk, requiring strong security technology to protect personal customer data and financial transactions. One way to strengthen data security and online privacy is through a VPN service, which stops unauthorized access.

According to the Conference of State Bank Supervisors’ sixth annual Bank Survey, seventy percent of participants ranked cybersecurity as a top priority. A Gartner study [2] indicates that cybersecurity and privacy top investment concerns for 66% of CIOs for 2023.

Operating in a highly regulated environment, banks must comply with laws and apply rigorous security measures, including GDPR and KYC. This compliance requires applying tailored solutions. Many banks still rely on antiquated systems, making it difficult to apply contemporary technologies without disturbing operations. Modifying or improving these systems requires careful planning.

Banks collect mountains of information, making data analytics and management essential. Properly storing and applying this data for organizational insights is challenging and requires advanced analytics and data governance solutions. According to the Global Transaction Banking White Paper, 62% of banks think Big Data solutions are crucial for their survival.

2024 Financial Inventions

Thanks to technological developments, the banking industry is undergoing radical change. Digitalization, automation, and data-driven insights have become main issues for banks aiming to simplify operations, enhance client experiences, and gain a competitive edge. Here is an overview of current banking sector technologies:

Internet Banks

As digital banking has expanded, consumer interactions with their banks have changed. Now defining criteria are online portals, mobile banking apps, and self-service options, which give clients real-time access to their accounts. Digital wallets loaded with credit cards and virtual money like Rendered, Ethereum, Bitcoin are becoming widespread. According to Economic Times, digital banking transactions by 2023 will reach $1 trillion.

Hyperautomation

Driven by hyperautomation, end-to-end automation combining robotic process automation (RPA) with artificial intelligence and machine learning drives demanding corporate processes. Using hyperautomation, banks can automate data input, document processing, customer onboarding, and rule-based, repetitive tasks. By automating these chores, banks reduce mistakes, boost operational efficiency, and free employees to focus on high-value projects.

Low-Code Proliferation

Low-code development solutions let banks create apps with minimal coding, accelerating development and reducing reliance on traditional coding methods. These solutions provide pre-built templates, drag-and-drop capability, and visual interfaces, allowing both technical and non-technical players to participate in application development.

Low-code development lets banks quickly build internal process simplifications, custom apps, and new consumer experiences.

Machine Learning and Artificial Intelligence

Banks increasingly use artificial intelligence and machine learning tools to raise operational efficiency, fraud detection, and enhance customer experiences. AI-driven virtual assistants and chatbots offer customized help and support. ML methods concurrently analyze large volumes of data for consumer segmentation and risk assessment.

Robotic Process Automation (RPA)

RPA has become popular in the banking industry, eliminating tiresome manual tasks and increasing operational effectiveness. Software robots assist banks by simplifying activities such as customer onboarding, data entry, and compliance checks, reducing mistakes, and boosting output.

Cloud Computing

Banks are using cloud computing to maximize infrastructure costs, boost scalability, and enable faster application deployment, saving money. Cloud-based solutions improve data security policies, agility, and system interface with other systems, allowing banks to expand rapidly and present new services.

Blockchain Technology

Blockchain is emerging as a disruptive player in the financial industry, altering everything from future bitcoin market trading to cross-border payments to identity verification. Its distributed and secure character can speed operations, minimize costs, and promote transaction transparency.

Big Data and Analytics

Data analytics and big data technology enable banks to undertake perceptive studies of vast consumer data, minimize risks, and maximize operations. Data analytics helps banks better understand consumer behavior, adapt offers, and make data-driven decisions.

Cybersecurity and Fraud Prevention

As cybersecurity and fraud protection become top issues, banks are funding advanced technologies like threat intelligence, encryption, and biometric authentication to protect consumer data and combat shifting threats.

Internet of Things (IoT)

IoT technologies enable actual items and devices to interact, allowing data collection and distribution. IoT presents banks with remote asset monitoring, real-time fraud detection, and customized user experiences. IoT technologies help banks monitor ATMs, maintain inventory levels, and give customized offers based on consumer locations and preferences.

Development Using DevOps and Automation

Combining software development with IT operations, DevOps methods aim to enable faster application deployment, continuous delivery, and integration. Using DevOps techniques raises system quality and reliability, reduces time-to-market for new services, and enhances cooperation between development and operations teams.

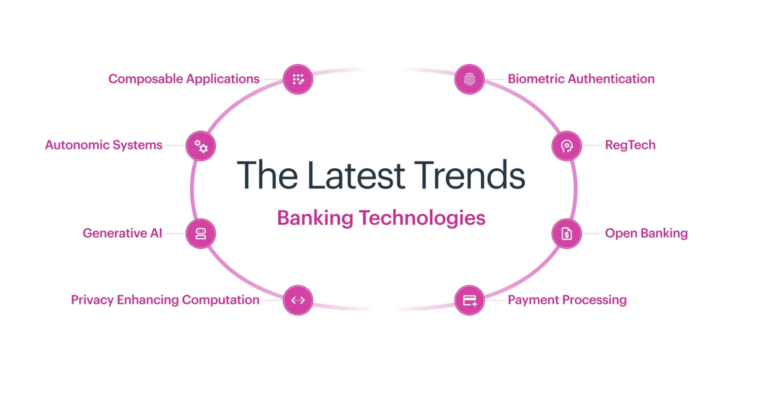

Modern Banking Technology: Trends and New Horizons

Driven by evolving consumer expectations and technology breakthroughs, the banking industry is undergoing significant change. Using new technologies, banks are supporting security, improving operational efficiency, and offering exceptional client experiences. Additional advancements include open banking, payment processing, biometric authentication, RegTech, and the rise of composable apps.

Biometric Authentication

Biometric identity technologies, including fingerprint recognition, facial recognition, and voice recognition, are becoming common in banking. These systems use unique biological features for user identification and authentication, enhancing security and simplicity.

Regulatory Technology (RegTech)

RegTech applies technology to speed up regulatory compliance procedures in banking. Solutions help banks automate risk management, reporting, and compliance monitoring, ensuring regulatory compliance, reducing costs, and limiting the risk of violations.

Open Banking

Open banking initiatives increase banking industry competitiveness and innovation by allowing consumers to safely trade financial data with approved third-party providers. Open APIs enable banks to work with fintech startups and other financial institutions to produce new products and services.

Payment Processing

Payment processing technology is evolving rapidly with the rise of digital payments. Banks are embracing real-time systems, mobile wallets, contactless payments, and other faster and safer payment solutions, enhancing convenience and security for consumers.

Composable Applications

Composable applications are modular, flexible approaches to application development, allowing new applications to be created by combining pre-built components and services. This method lets banks quickly construct and use apps, providing agility, scalability, and faster time-to-market.

Autonomous Systems

Autonomic systems enhance client experiences, minimize human error, and raise operational efficiency by self-diagnosing and self-correcting, optimizing processes, and reducing downtime.

Privacy-Enhancing Computation (PEC)

PEC technology allows banks to handle personal data with privacy protection. PEC approaches enable confidentiality and secure data sharing, allowing banks to gain insights from client data without violating privacy.

Generative Artificial Intelligence

Generative AI lets banks produce smart, contextually relevant responses, recommendations, and financial insights from massive data sets, transforming risk management, customer relationships, and product innovation.

Giving 2023 Top Focus for Technological Investments:

Most banking CIOs must prioritize their investments strategically as technology constantly changes the sector. Determining the right investments to support regulatory compliance, boost customer experiences, and inspire innovation can be challenging.

Create a Technology Roadmap

Match technology investments with business goals to create a strategic roadmap guaranteeing scalability and agility, enabling phased implementation.

Enhance IT Infrastructure

Use cloud computing, upgrade current systems, and consider IaaS and PaaS models to boost scalability, adaptability, and cost efficiency.

Implement Agile Methods

DevOps and other agile methods can speed up software development, improve teamwork, and allow quick response to changing market needs.

Coordinate Initiatives

Leverage industry partners, technology providers, and fintech companies for quick innovation and expanded service offerings.

Prioritize Regulatory Compliance

Invest in RegTech solutions to ensure compliance, simplify reporting processes, and reduce operational and reputational risks.

Selecting Suitable Financial Technologies

Choosing suitable banking technology is crucial for CIOs and IT managers. The process must ensure regulatory criteria are met, provide a secure environment, and align with the bank’s goals. Key practices include:

Embrace Digital Transformation

Efficient technology overcoming has strategic significance. Banks might streamline processes, enhance client experiences, and drive business expansion by leveraging digital capabilities.

Start with Data Governance

Data is a vital resource. Banks should prioritize integrity, security, and compliance, establishing data governance systems, stewardship responsibilities, and quality management strategies.

Apply Agile Methods

Agile methods, including iterative development and continuous delivery, help banks meet customer expectations, hasten product development, and reduce time-to-market.

Use Strong Security Measures

Multi-layered security systems, including advanced authentication and encryption, protect consumer data and maintain regulatory compliance.

Build a Technology Roadmap

A comprehensive roadmap aligning with corporate goals includes technical costs, implementation plans, and strategic objectives, ensuring a methodical approach to technology adoption.